The “Sticker Shock” of Senior Care: A Reality for Millions

You’ve just received the quote from a home care agency, and your stomach drops. Finding affordable elderly home care becomes an urgent priority when costs are higher than expected. Exploring different options for affordable elderly home care helps families discover solutions that balance quality and budget. By researching programs, subsidies, and community resources, you can create a plan that ensures consistent, reliable affordable elderly home care. With careful planning, affordable elderly home care allows your loved one to receive the support they need without financial stress.

What Does “Affordable Elderly Home Care” Really Mean?

It’s crucial to understand that affordable elderly home care does not mean compromising on quality. Finding affordable elderly home care means securing reliable, professional support that fits within your family’s budget. By exploring different programs and service combinations, you can create a plan for affordable elderly home care that maximizes value and safety. In 2025, affordable elderly home care integrates services, funding options, and technology to ensure your loved one receives the best possible care without financial strain.

The national median cost for a home health aide is over $6,000 per month, according to the latest data from sources like the Genworth Cost of Care Survey. This price point is simply unattainable for many. As a result, the trend is shifting toward hybrid models: combining fewer hours of professional care with family caregiver support, utilizing telehealth for check-ins, and leveraging community programs to fill the gaps. Affordability in 2025 is about building a mosaic of care, not just writing a single check.

Why Finding an Affordable Solution is Critical

The search for affordable elderly home care isn’t just a financial exercise; it directly impacts the well-being of your loved one and the entire family. Exploring different options for affordable elderly home care helps ensure high-quality support without overspending. By carefully planning and comparing providers, you can secure consistent, reliable affordable elderly home care that meets your loved one’s needs. Thoughtful research and resourcefulness make affordable elderly home care achievable while maintaining comfort, safety, and peace of mind.

Preventing Family Financial Ruin

Without a sustainable plan, families often burn through savings at an alarming rate. This can jeopardize the financial security of adult children, impacting their own retirement plans and ability to pay for their kids’ education. A well-structured, affordable plan protects the entire family’s financial future.

Ensuring Continuity and Quality of Care

When care is too expensive, families are often forced to reduce hours or stop services abruptly. This inconsistency is detrimental to a senior’s health and routine. An affordable plan allows for consistent, long-term care, which is essential for managing chronic conditions and maintaining a stable, secure environment.

Reducing Caregiver Burnout

When professional help is unaffordable, the burden falls entirely on family members. This can lead to extreme stress and burnout. **Budget senior caregiving** solutions, even for a few hours a week, provide essential respite for family caregivers, allowing them to rest and recharge, which ultimately makes them better caregivers.

Just as a farmer must implement a detailed financial strategy for the sustainability of their animals and farm, families must create a comprehensive plan for their aging loved ones. Managing these costs ensures a safe and nurturing environment. For insights into detailed planning in other fields, you can review resources like this guide on farm management.

How It Works: Key Strategies for Affordable Care

Finding affordable elderly home care requires a multi-pronged approach that balances quality and budget. Exploring different programs and options for affordable elderly home care helps families discover cost-effective solutions. By combining resources, subsidies, and local services, you can create a plan for affordable elderly home care that meets your loved one’s needs. Thoughtful planning and research make affordable elderly home care achievable without sacrificing safety, comfort, or well-being.

1. Tap into Government and VA Programs: This is the most underutilized resource. Medicaid waivers (HCBS) can cover extensive in-home care for low-income seniors. For veterans, the VA’s Aid and Attendance benefit can provide a significant monthly stipend for care. These programs are bureaucratic but can be a financial lifeline.

2. Contact Your Local Area Agency on Aging (AAA): Every county has one. These are federally funded organizations that are a one-stop-shop for local resources. They can connect you with subsidized meal programs (Meals on Wheels), transportation services, and respite grants for family caregivers.

3. Structure Care Creatively: You may not need 24/7 care. Analyze your loved one’s routine. Perhaps you only need a professional caregiver for a few hours in the morning to help with bathing and dressing, and again in the evening. This is far more affordable than a full-day shift.

4. Use Long-Term Care Insurance (If Available): If your loved one planned ahead and has a policy, now is the time to activate it. Understand the policy’s elimination period and daily limits to maximize its benefits.

5. Explore PACE Programs: The Program of All-Inclusive Care for the Elderly (PACE) is a Medicare/Medicaid program that provides comprehensive medical and social services to seniors, helping them stay in their homes. It’s an excellent option for those who qualify.

Real-Life Story: The Millers’ Mosaic of Care

“My mom needed help, but with her on a fixed income, we thought professional care was impossible. The first quote was for $7,000 a month. We were devastated. Then we called our local Area Agency on Aging. They were incredible.”

“They helped us discover that because my dad was a Korean War veteran, Mom was eligible for a VA survivor’s pension that covered about 15 hours of care a week. They also connected us with a respite grant that gave my sister and me a break. We combined the professional caregiver with our own schedules and a subsidized meal delivery service. Our total out-of-pocket cost is now less than $1,500 a month. It was a puzzle, but the AAA helped us find all the pieces.”

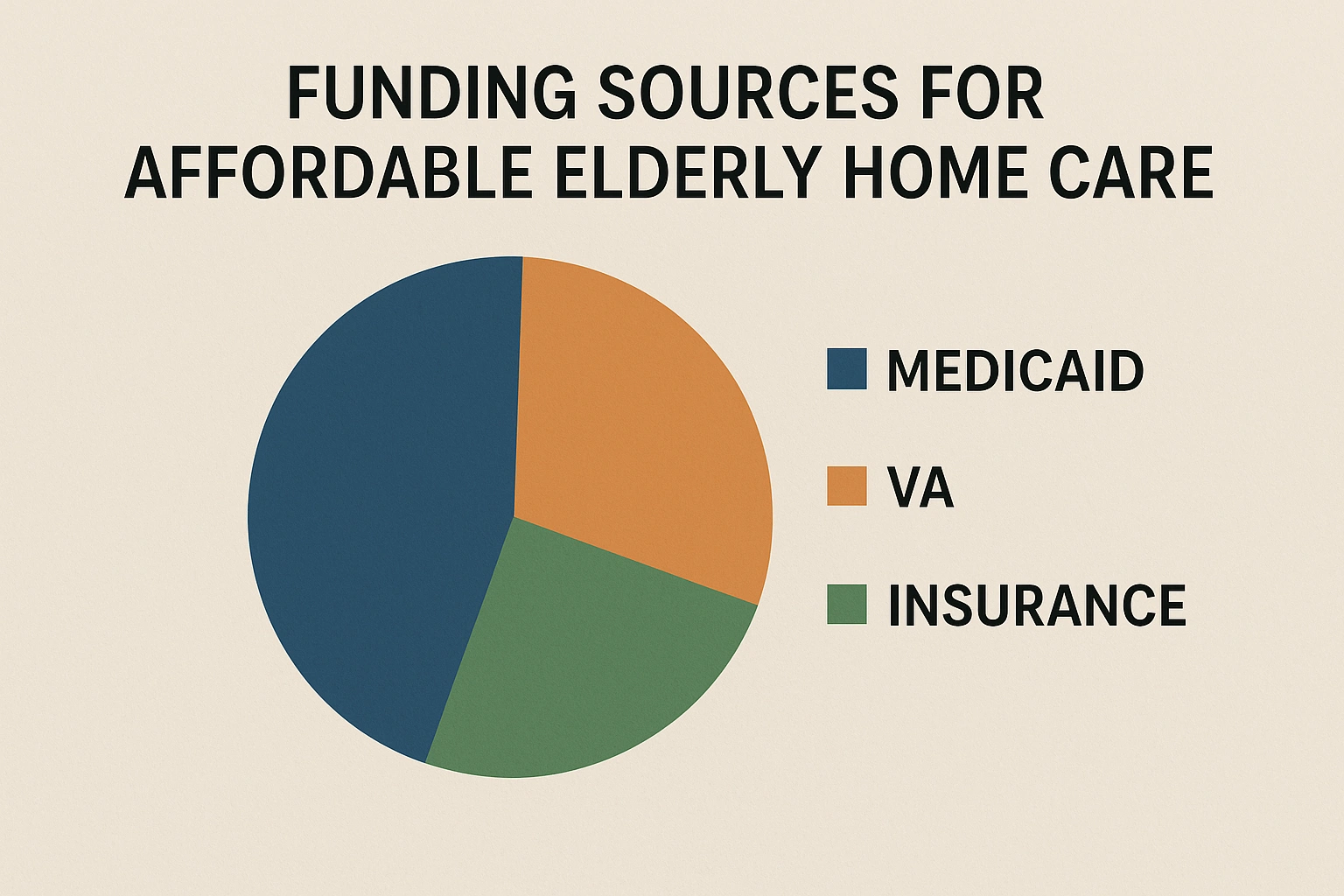

Comparison of Key Funding Sources

Understanding the pros and cons of each payment method is essential for building your financial plan.

| Funding Source | Eligibility | Pros | Cons |

|---|---|---|---|

| Private Pay / Savings | None | Total flexibility and choice of provider. | Fastest way to deplete assets; unsustainable long-term. |

| Long-Term Care Insurance | Must have an existing policy and meet its criteria. | Significantly offsets costs; protects savings. | Policies have limits; premiums can be high. |

| Medicaid (HCBS Waivers) | Strict low-income and asset limits. | Can cover comprehensive, long-term care. | Complex application; may have waiting lists. |

| VA Benefits (Aid & Attendance) | Wartime veterans or spouses with specific care needs. | Provides a significant monthly, tax-free payment. | Application process can be very long and complex. |

7 Financial Mistakes to Avoid

When trying to make care affordable, families can inadvertently make costly errors.

- Assuming Medicare Pays for Long-Term Care: This is the most common myth. Medicare only covers short-term, skilled care after a hospitalization, not long-term custodial care.

Fix: Immediately shift your research focus to Medicaid, VA benefits, and other sources.

- Ignoring Your Area Agency on Aging (AAA): Not calling your local AAA is like leaving money on the table. They are a free, unbiased resource hub.

Fix: Find your local AAA through the [NCOA’s website](https://www.ncoa.org/) and make an appointment.

- Transferring Assets Incorrectly: Trying to qualify for Medicaid by giving away money or property can trigger a penalty period, making your loved one ineligible for years.

Fix: Never transfer assets without consulting an elder law attorney first.

- Hiring Under the Table: Paying an independent caregiver cash to save money is illegal and risky. You have no recourse if something goes wrong, and you could face tax penalties.

Fix: Either use a reputable agency or set up a proper payroll system for a direct hire.

- Not Discussing Finances as a Family: Money is a sensitive topic, but secrets and assumptions lead to resentment and poor planning.

Fix: Hold an open family meeting to discuss budget, resources, and how siblings can contribute fairly (financially or with time).

- Overlooking Respite Care: Family caregivers who don’t take breaks burn out. Burnout leads to illness and the potential need for more expensive, full-time care.

Fix: Budget for respite care from the start. It’s a necessary investment in the primary caregiver’s health.

- Waiting for a Crisis to Plan: The worst time to make financial decisions is during an emergency.

Fix: Have conversations about long-term care financing *before* it’s needed. Understand your loved one’s financial picture and wishes.

Expert Tips for Budget Senior Caregiving

Proactive steps can make a significant difference in the total cost of care.

- Negotiate with Agencies: “While there’s a standard rate, some agencies offer discounts for a guaranteed number of hours per week or for paying for a month in advance,” notes a financial planner specializing in senior care. “It never hurts to ask.”

- Conduct a Home Safety Audit: Preventing one fall can save you thousands in hospital bills. Install grab bars, improve lighting, and remove tripping hazards. This can reduce the level of physical assistance needed.

- Maximize Community Resources: Use free or low-cost services like senior center activities, volunteer companion programs, and church-based support groups to supplement professional care.

- Review Insurance Policies: Check if a life insurance policy has an ‘accelerated death benefit’ rider, which allows you to access a portion of it while the insured is still alive to pay for care.

- Consider a Reverse Mortgage: This can be a complex and risky option, but for some house-rich, cash-poor seniors, it can be a way to fund in-home care without having to sell their home. Always seek advice from a HUD-approved counselor.

Frequently Asked Questions (FAQ)

Is it always cheaper to hire a caregiver independently?

While the hourly rate for an independent caregiver is often lower, you become the employer. This means you are responsible for payroll taxes, liability insurance, and worker’s compensation. These ‘hidden costs’ can significantly close the price gap and add administrative complexity. Agencies handle all of this for you, offering a simpler, though often higher-priced, solution.

Are there any tax deductions for elderly care costs?

Yes, potentially. If your parent qualifies as a dependent, you may be able to claim the Credit for Other Dependents. Additionally, medical expenses related to care, including some in-home care costs, can be tax-deductible if they exceed a certain percentage of your adjusted gross income. It’s best to consult a tax professional for personalized advice.

What is a Medicaid ‘spend-down’?

A Medicaid spend-down is a strategy for individuals whose income or assets are slightly too high to qualify for Medicaid. They can ‘spend down’ their excess assets on medical care and bills, including home care, until they meet the financial eligibility threshold for their state. The rules are complex and vary by state, so professional guidance is highly recommended.

Can I get paid to be a caregiver for my own parent?

Yes, in many states. Programs like Medicaid’s Home and Community-Based Services (HCBS) waivers often have ‘participant-directed’ options that allow a senior to hire a family member as their caregiver. Some VA programs and state-specific initiatives also offer this. Check with your local Area Agency on Aging for programs in your region.

Does long-term care insurance cover all home care costs?

Not necessarily. Policies vary greatly. Most have a daily or monthly benefit limit and a lifetime maximum. There’s often an ‘elimination period’ (like a deductible) where you pay out-of-pocket for a set number of days before coverage kicks in. It’s crucial to read your specific policy to understand its exact benefits and limitations.

Conclusion: Affordability Through Smart Planning

The high cost of care can be intimidating, but finding affordable elderly home care ensures your loved one still gets the support they need. Exploring different options for affordable elderly home care allows families to balance quality and cost effectively. By combining resources and programs, you can create a plan that provides consistent, reliable affordable elderly home care. Thoughtful research and proactive planning make affordable elderly home care achievable without compromising comfort, safety, or well-being.

By moving past the initial sticker shock and exploring the options outlined in this guide, you can create a plan that provides excellent care for your loved one and financial peace of mind for your entire family. The solution is rarely simple, but with diligence and the right information, it is always possible. For ongoing support, resources like the Family Caregiver Alliance offer a wealth of information on navigating the financial challenges of caregiving.