The dream of a comfortable retirement is universal, but many worry about the cost. Exploring affordable retirement living can show that a vibrant, supportive, and safe retirement is within reach. By comparing different affordable retirement living options, you can find communities that match your budget without sacrificing quality. Planning carefully and considering affordable retirement living allows you to enjoy peace of mind while making the most of your retirement years.

The good news is that finding affordable retirement living is absolutely possible. Knowing how to search for affordable retirement living helps you focus on communities that fit your budget and lifestyle. This guide explores strategies for affordable retirement living, including factors that influence cost and ways to maximize value. By following tips on affordable retirement living, you can create a practical roadmap to enjoy a secure, comfortable, and fulfilling retirement.

What Does “Affordable Retirement Living” Really Mean?

“Affordable” doesn’t just mean “cheap.” Finding affordable retirement living is about balancing value and quality, choosing a community that fits your needs. Exploring affordable retirement living options helps you enjoy social connection, comfort, and security without overspending. By comparing different affordable retirement living opportunities, you can ensure your monthly fees remain manageable. Planning carefully with affordable retirement living in mind allows you to maintain your lifestyle while protecting your long-term financial well-being.

The trend in 2025 is a move away from the luxury-only market toward a wider range of options. As a Pew Research Center analysis shows, the senior population is becoming more economically diverse. This has spurred the development of more middle-market options and a renewed focus on creative housing solutions. The goal of this guide is to help you navigate this evolving landscape and find a place that offers financial peace of mind.

Why Finding an Affordable Option is So Important

This decision is about more than just balancing a checkbook; it’s about safeguarding your future well-being and independence. A financially sustainable choice is a cornerstone of a stress-free retirement.

Preserving Your Nest Egg

The most obvious benefit is making your retirement savings last longer. An affordable community ensures that you have funds available not just for housing, but for healthcare, travel, hobbies, and leaving a legacy for your loved ones.

Reducing Financial Stress and Anxiety

Worrying about how to pay the bills each month can take a serious toll on your mental and physical health. Choosing a community that fits comfortably within your budget eliminates this chronic stress, freeing you to actually enjoy your retirement.

Ensuring Access to Care When You Need It

Sometimes, the most affordable option in the long run is one that includes care. A budget-friendly assisted living community can prevent the far greater expense of emergency in-home care or a private nursing facility after a health crisis. As discussed on sites like peternakan.web.id, planning for future care is a wise investment.

Key Drivers of Affordability in Senior Living

Understanding what factors into the final price tag is crucial for finding value. Here are the main components that dictate cost.

1. Location, Location, Location

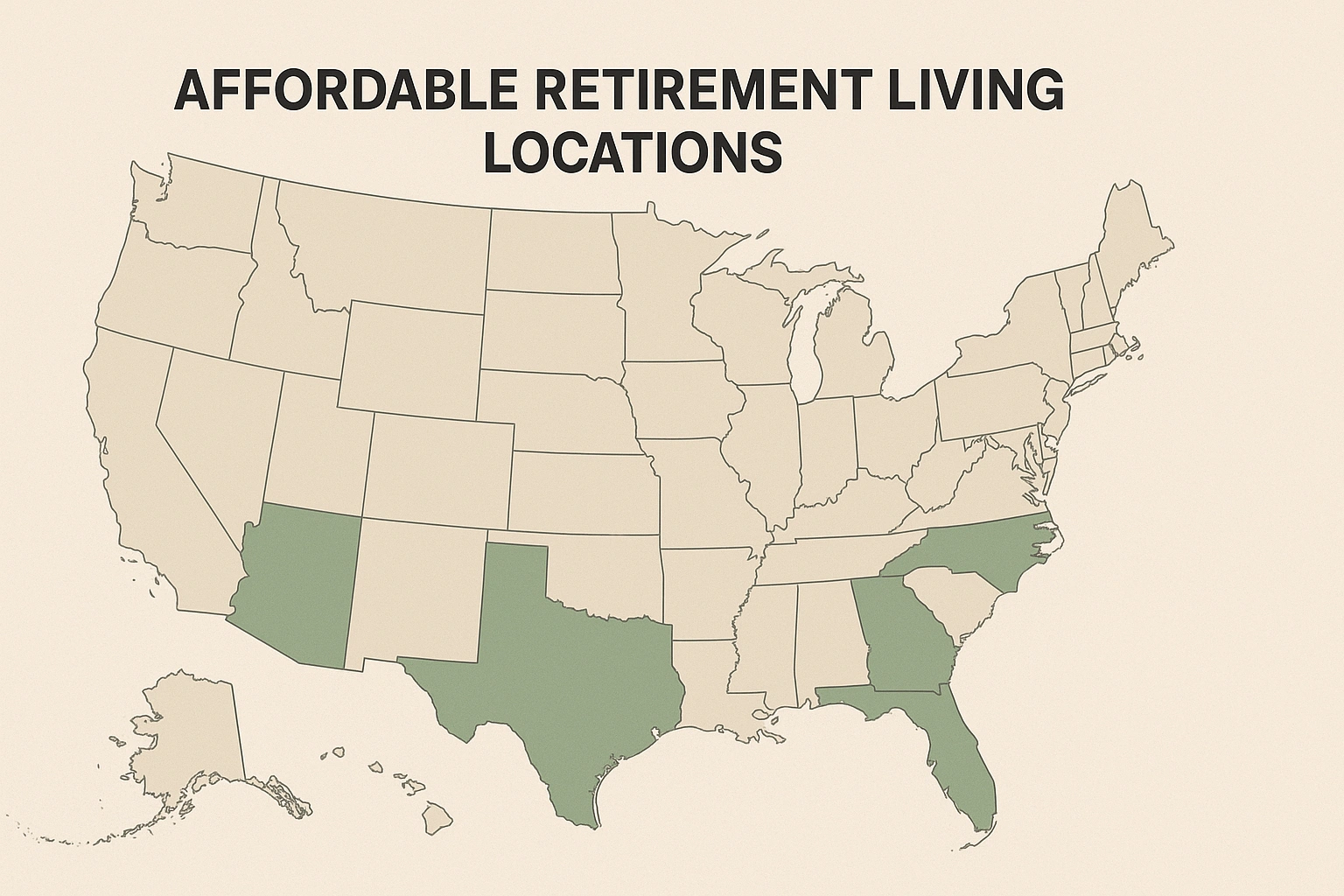

This is the single biggest factor. A community in a major metropolitan area in California or New York will cost multiples of a similar community in a smaller city in the Midwest or Southeast due to differences in real estate prices and labor costs.

2. Type of Community and Services

The level of care provided directly impacts the price. Independent living is the least expensive, followed by assisted living, with memory care and skilled nursing being the most costly. The more hands-on care, the higher the price.

3. Amenities and Finishes

A community with a swimming pool, a state-of-the-art fitness center, and gourmet dining will naturally cost more than one with more modest, but perfectly functional, amenities. Be honest about what you will actually use.

Finding Value: A Real-Life Scenario

Meet Sarah, a retired teacher on a fixed pension. She wanted to move closer to her daughter but found the assisted living communities in her daughter’s suburban city were too expensive. Instead of giving up, she expanded her search. She discovered a wonderful, highly-rated community in a smaller town just 45 minutes away. The monthly cost was 30% lower, and the smaller-town atmosphere was a perfect fit for her. By being flexible on location, Sarah found a high-quality, affordable retirement living option that met her care needs and her budget, while still allowing for frequent family visits.

Strategies for Finding Affordable Senior Care Communities

Here are several proven strategies to employ in your search for a budget-friendly community.

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Relocate to a Lower-Cost State | Move to a state with a lower cost of living and favorable tax laws for retirees. | Massive potential savings on housing and taxes. | Can be emotionally difficult to leave family. |

| Look Outside Major Metro Areas | Search for communities in suburbs or smaller towns. | Significant savings, often with less traffic. | Fewer specialized healthcare options. |

| Consider a Companion Suite | Share a two-bedroom apartment with another resident. | Can dramatically reduce monthly rent. Built-in companion. | Loss of complete privacy. Requires a compatible roommate. |

| Explore Non-Profit Communities | Look for communities run by religious or fraternal organizations. | Often have a mission of service and may offer more affordable rates. | May have long waiting lists. |

Common Financial Mistakes to Avoid

Be wary of these financial traps when evaluating your options.

- Ignoring the Annual Rate Increase: Nearly every community raises its rates annually. Ask for the rate increase history for the past 3-5 years (it’s often 3-6%) and factor that into your long-term budget.

- Misunderstanding the Fee Structure: Is the pricing all-inclusive, or are there different “levels of care” that trigger higher fees? Get a written breakdown of exactly what is included at each price point.

- Forgetting About a One-Time “Community Fee”: Many communities charge a non-refundable, one-time fee upon move-in that can be several thousand dollars. Make sure to ask about this upfront.

- Not Having a Long-Term Care Plan: If you’re moving into independent living, what is your financial plan if you eventually need assisted living? Thinking ahead is crucial.

Expert Tips & Best Practices

Use these insider tips to find the best value for your money.

- Work with a Senior Living Advisor: A reputable, local advisor can be an invaluable resource. They know the local market, including which communities have the best reputations and pricing. Their services are typically free to you (they are paid by the community).

- Ask About Move-In Specials: “Don’t be afraid to ask if there are any current promotions, like a waived community fee or a locked-in rate for the first year,” advises financial planner James Chen. “This can result in significant upfront savings.”

- Consider Selling Your Life Insurance Policy: A life settlement, where you sell your policy for a lump sum, can be an option to fund long-term care, but it should be explored carefully with a financial advisor.

- Look Into Veterans Benefits: Eligible veterans and their spouses may qualify for the Aid and Attendance benefit, a monthly pension that can help offset the costs of assisted living.

Frequently Asked Questions (FAQ)

Q: What is considered ‘affordable’ for retirement living?

A: Affordability is relative and depends on your income, savings, and assets. A general financial rule of thumb suggests that housing costs should not exceed 30% of your gross monthly income. For retirement living, this would include the monthly fees for rent, services, and any additional care.

Q: Are there government programs to help pay for senior care communities?

A: Yes, but they are often limited. The U.S. Department of Housing and Urban Development (HUD) has programs for low-income seniors. Additionally, some states have Medicaid waiver programs that can help cover the cost of services in assisted living, but they do not typically cover room and board. Medicare does not pay for long-term custodial care.

Q: Does relocating to a cheaper state really save money?

A: It can save a significant amount. States with a lower cost of living and no state income tax on retirement benefits can stretch your savings considerably. However, you must also factor in the costs of moving and the emotional aspect of being farther from family.

Q: What are some common hidden fees to watch out for?

A: Look for community fees (one-time, non-refundable), tiered pricing for care that can increase unexpectedly, fees for transportation to non-scheduled appointments, and extra charges for services like medication management or special dietary needs.

Q: Is it better to rent or choose a community with a buy-in fee?

A: Renting offers more flexibility and lower upfront costs. Buy-in or ‘entry fee’ communities, often CCRCs, require a large upfront payment but can offer more predictable monthly fees and guaranteed access to higher levels of care. The best choice depends on your financial situation and long-term planning goals.

Conclusion

Finding affordable retirement living is about making smart, informed choices without sacrificing quality. Exploring affordable retirement living options helps you identify communities that offer comfort, social connection, and security. By comparing different affordable retirement living opportunities, you can understand the factors that influence cost and make better decisions. Planning ahead and considering affordable retirement living carefully allows you to create a retirement that is both enjoyable and financially secure.

For more resources on paying for care and finding local options, the National Council on Aging (NCOA) offers a wealth of trusted information. Your financially secure future awaits.

What is your biggest concern when it comes to affording retirement living? Share your thoughts in the comments below!